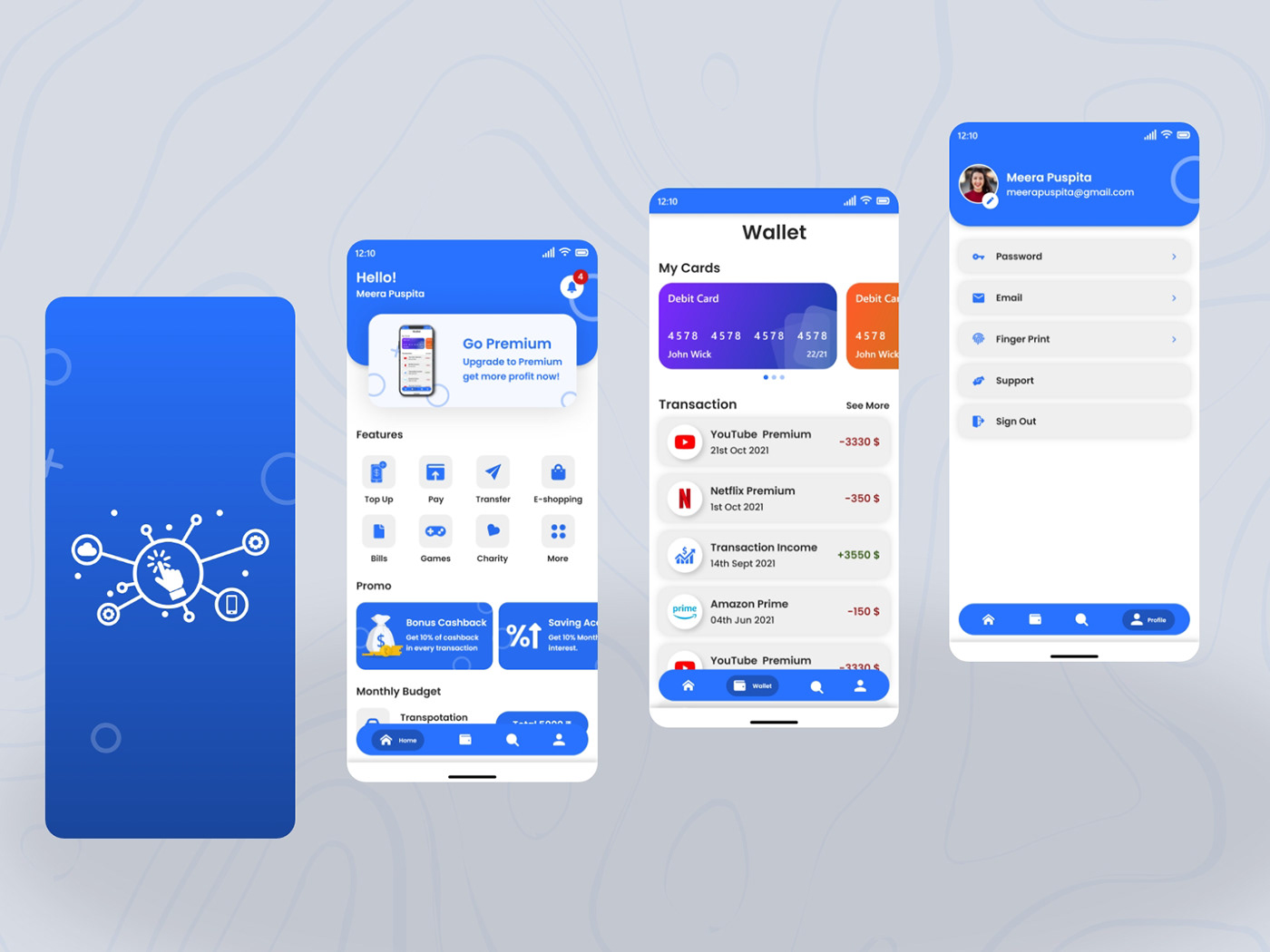

Top 8 Digital Wallet Apps Revolutionizing Digital Payments in 2024

As the world moves towards cashless transactions, the top e-wallet apps 2024 are shaping the future of how we handle money. Whether you’re shopping online, splitting the bill with friends, or managing your finances, digital wallets for secure payments provide seamless, secure, and convenient solutions. In this blog post, we explore the best e-wallet apps revolutionizing digital payments in 2024 and why they are must-haves for modern users.

What is an E-Wallet App?

An e-wallet app, or digital wallet, is a mobile application that allows users to store, manage, and make secure digital payments via their smartphones or other devices. These apps not only store credit or debit card information but also enable contactless payments, ensuring speed and convenience for everyday transactions.

In addition to payment processing, many e-wallets offer advanced features like peer-to-peer transfers, cryptocurrency trading, budgeting tools, and reward points. These apps use encryption and tokenization to ensure that financial data is secure during transactions. With the rise of contactless payments and e-commerce, e-wallet apps have become essential tools for managing everyday financial transactions, offering speed, security, and convenience.

Top 8 E-Wallet Apps Revolutionizing Digital Payments in 2024

1. PayPal

Overview:

As a global leader in digital wallets for secure payments, PayPal allows users to handle online transactions, money transfers, and make contactless payments in-store. Supporting multiple currencies, it has become one of the best e-wallet apps for international transactions.

Key Features:

- Global availability

- Merchant integration for businesses

- Fast online checkout options

User Experience:

With its intuitive design, PayPal is easy to use for both individuals and businesses, allowing for quick payments, money transfers, and merchant transactions.

Security Measures:

PayPal employs industry-leading security measures such as two-factor authentication, encryption, and buyer/seller protection, ensuring that all transactions are safe and secure.

Popularity:

With a staggering 490 million active users worldwide, PayPal remains a dominant player in the e-wallet space. In the first half of 2024 alone, it processed an impressive $400 billion in total payment volume (PayPal Annual Report 2024), demonstrating its continued influence in the digital payments market.

Unique Benefits:

PayPal’s wide acceptance across global merchants, combined with its multi-currency support and business-friendly invoicing features, makes it a top choice for both consumers and enterprises.

2. Google Pay

Overview:

Google Pay provides an all-in-one solution for digital wallets for peer-to-peer payments, in-store purchases, and bill payments. Users can securely store their debit and credit cards, loyalty rewards, and even boarding passes, making it a comprehensive digital wallet for everyday use. Backed by Google, it’s increasingly becoming a go-to e-wallet for Android users.

Key Features:

- Facilitates peer-to-peer money transfers

- Enables contactless in-store purchases

- Loyalty card integration

- Seamless integration with Google accounts

User Experience:

Google Pay provides a seamless, all-in-one experience for managing payments and personal cards. Its intuitive interface allows users to quickly make payments, store important cards, and access them whenever needed.

Security Measures:

Tokenization, encryption, and biometric authentication (fingerprint, face recognition) ensure that transactions are secure.

Popularity:

With over 200 million active users globally in 2024 (Statista), Google Pay is one of the fastest-growing digital wallets. It is integrated with 85% of global retailers and is continually expanding into new regions, including Eastern Europe and South America, further solidifying its presence worldwide.

Unique Benefits:

The integration with Google services, such as Gmail and Google Shopping, enhances convenience for users.

3. Apple Pay

Overview:

Apple Pay is Apple’s secure, fast, and user-friendly e-wallet, exclusively for iPhone, iPad, and Apple Watch users. Its tight integration into the Apple ecosystem makes it a powerful player in the digital wallet market. In addition to payments, Apple Pay supports loyalty programs, boarding passes, and tickets.

Key Features:

- One-tap payments

- Online payments via Safari browser

- Full integration with Apple devices

User Experience:

Apple Pay offers a highly intuitive and secure payment process, leveraging Face ID and Touch ID for easy authentication. Its seamless integration across Apple’s ecosystem ensures that users can make quick payments from any of their devices.

Security Measures:

Apple Pay uses tokenization, biometric authentication, and encryption to protect user data. It doesn’t store card numbers on devices or Apple servers.

Popularity:

As of 2024, Apple Pay boasts 600 million users worldwide, a significant jump from 500 million in 2023. It is now accepted by 95% of U.S. retailers, making it one of the most widely supported payment methods in the country.

Unique Benefits:

The seamless authentication via Face ID and Touch ID, combined with its broad acceptance by U.S. retailers, positions Apple Pay as a top choice for consumers who value convenience and security.

4. Cash App

Overview:

Developed by Square, Cash App allows users to send money to friends, buy Bitcoin, and even invest in stocks—all in one platform. It’s popular for its peer-to-peer payment features and investment opportunities.

Key Features:

- Peer-to-peer money transfers

- Buy and sell Bitcoin

- Stock investments and direct deposits

User Experience:

Cash App stands out for its simplicity, making it easy for users to send payments or invest in stocks and cryptocurrency, all within a few taps. This user-friendly experience has made it a favorite among those seeking a no-fuss, versatile financial app.

Security Measures:

Cash App includes encryption, PIN entry, and two-factor authentication to keep users’ money secure.

Popularity:

By 2024, Cash App has grown to 57 million monthly users, with an impressive revenue of $14.68 billion in 2023. Its widespread use for peer-to-peer transfers, stock investments, and cryptocurrency transactions solidifies its position as a leading digital wallet in the U.S.

Unique Benefits:

What sets Cash App apart is its integration of stock trading and Bitcoin transactions, making it a one-stop-shop for users looking to manage payments, invest, and trade cryptocurrency—all in one place.

5. Samsung Pay

Overview:

Samsung Pay is Samsung’s answer to the digital wallet trend, enabling payments via mobile devices. What makes it stand out is its MST (Magnetic Secure Transmission) technology, which allows it to work with both new and older payment terminals.

Key Features:

- Contactless payments via NFC and MST technology

- Integration with Samsung services

- Reward points system for purchases

User Experience:

Samsung Pay is easy to use, especially for Samsung Galaxy users, offering an intuitive and consistent experience across devices.

Security Measures:

Samsung Pay uses Knox security, biometric authentication (fingerprints, iris scanning), and tokenization to protect transactions.

Unique Benefits:

The ability to use older magnetic strip card readers makes Samsung Pay versatile in locations where contactless payments may not be available.

6. Venmo

Overview:

Venmo stands out with its unique social payment features, allowing users to view, like, and comment on their friends’ transactions. In addition to its social aspect, Venmo offers instant transfers to bank accounts, making it a go-to app for personal payments like splitting bills, paying rent, or sharing expenses.

Key Features:

- Peer-to-peer transfers with social features

- Split bills easily

- Integration with some merchants for in-app purchases

User Experience:

Venmo combines the ease of peer-to-peer payments with a social element, making transactions fun and engaging. The instant transfer feature also adds convenience, allowing users to quickly access funds in their bank accounts.

Security Measures:

Venmo secures transactions with encryption, PIN code entry, and multi-factor authentication.

Popularity:

Venmo processed over $250 billion in transactions in 2024, reflecting a 9% growth from the previous year (Business of Apps 2024). With 95 million active users, it continues to be a leading choice for peer-to-peer payments across the U.S.

Unique Benefits:

Venmo’s blend of social interaction and financial transactions, paired with instant bank transfers, makes it a preferred platform for friends and families looking to manage everyday payments with ease and enjoyment.

7. Zelle

Overview:

Zelle allows users to send money instantly between bank accounts without the need for a separate e-wallet balance. It works through a network of partnered banks in the U.S.

Key Features:

- Instant bank-to-bank transfers

- No need to download an additional app if your bank supports it

- No fees for most transactions

User Experience:

Zelle offers a seamless experience for users with its integration into existing banking apps, eliminating the need to manage a separate app.

Security Measures:

Bank-level security measures, including encryption and multi-factor authentication, keep transactions safe.

Popularity:

With wide integration across major U.S. banks, Zelle is highly popular for domestic money transfers.

Unique Benefits:

The direct connection to your bank account makes Zelle fast, easy, and convenient for users who don’t want to manage an extra wallet.

8. Revolut

Overview:

Revolut offers a feature-rich multi-currency wallet with budgeting tools, currency exchange, and cryptocurrency trading. It’s perfect for users who want a financial super app.

Key Features:

- Multi-currency account

- Cryptocurrency trading and budgeting tools

- Stock trading and premium account services

User Experience:

Revolut provides a comprehensive financial management tool beyond just payments, allowing users to manage their money, trade currencies, and invest.

Security Measures:

Revolut uses transaction limits, 3D Secure for online payments, and biometric authentication to safeguard user accounts.

Popularity:

Highly popular in Europe and expanding globally, Revolut is favored by travelers and those who deal with multiple currencies.

Unique Benefits:

Its multi-currency support and ability to trade cryptocurrency make it ideal for users looking for more than just a payment app.

Build Your Digital E-Wallet App with QSoft

To stay competitive in 2024, having a state-of-the-art e-wallet app is crucial. Whether you’re focused on peer-to-peer payments or interested in digital wallets with cryptocurrency features, QSoft can help you create the best e-wallet app for your business. We specialize in e-wallet app development tailored to meet your specific needs, ensuring your digital wallet solution offers secure digital payments and scales with your growing user base.

Why Choose QSoft?

- Expertise: With years of experience in the fintech industry, we know what it takes to build secure and innovative e-wallet apps.

- Customization: We offer tailored solutions, whether you need peer-to-peer payments, loyalty integrations, or cryptocurrency features.

- Security: QSoft prioritizes robust security protocols, including encryption, tokenization, and compliance with regulatory standards.

- Scalability: We design apps that grow with your business, ensuring seamless performance even as your user base expands.

Conclusion

In 2024, e-wallet apps are not just about making payments—they are transforming the way we manage money. With advanced security features, global reach, and innovative functionality, apps like PayPal, Google Pay, Apple Pay, and Revolut are leading the charge. Whether you’re looking for convenience, security, or a comprehensive financial tool, these apps are revolutionizing digital payments and are set to shape the future of finance.

Ready to create your own e-wallet app? Contact QSoft today and let’s revolutionize the way your customers pay!